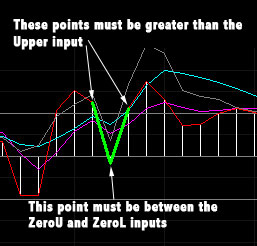

Program 45 is designed to look for ‘zero rejection’ patterns in the Commodity Channel Index (CCI). Some view zero rejection patterns as a sign of a potential reversal. The program defines a bullish zero rejection pattern as being one where price comes down from above a user defined value, to a user defined range, and then moves up above a user defined value. Similarly a bearish zero rejection pattern is defined as being one where price comes up from below a user defined value, to a user defined range, and then moves back down below the user defined value. The following diagram shows this concept more clearly, including the names of the appropriate user inputs.

If the DrawText user input is set to FALSE and the indicator is applied to a subgraph, the pattern is highlighted. If DrawText is set to TRUE and the indicator is applied to the main price chart then text is added to the chart. The video below explains how to set up the workspace.

The program is user configurable and the user may look for zero rejection patterns on regular CCI, Fast CCI, Markplex smoothed CCI or Markplex fast smoothed CCI. The user may select the CCI using the WhichCCI user input (like program 44). A setting of 1 is for regular CCI, 2 is for fast CCI, 3 is for Markplex smoothed CCI and 4 is for Markplex smoothed fast CCI.

The CCI itself is configured by the following inputs: CCILength, FastLength, SmoothLength and FastSmoothLength.

In the video below, I demonstrate how to create a workspace where the indicator prints the words: ‘BullZR’ or ‘BearZR’ on the price action shown on subgraph one when a pattern is confirmed. On subgraph 2 the various CCIs are plotted together with patterns highlighted and lines drawn on the patterns. In order to achieve this configuration DrawText must be set to TRUE for the indicator applied to sub graph 1 and DrawText must be set to FALSE for the indicator applied to sub graph 2. A complete list of inputs may be found below.

Program 45 is compatible with MultiCharts and TradeStation.

The unprotected EasyLanguage indicator and protected smoothed CCI function are available for immediate download for $29.95 by clicking the ‘add to cart’ button. You can pay with credit card or PayPal.

As usual, Gold Pass members get an additional 20% discount off all program and tutorial prices. If you are a Gold Pass member make sure you enter the special coupon code to get 20% discount off these prices.

Video explanation of the CCI Zero Rejection Finder

Inputs

ZeroU( 10 ), // Determines range of the pointed end of the zero rejection

ZeroL( 0 ), // Determines range of the pointed end of the zero rejection

Upper( 50 ), // Absolute price level prior to and after zero rejection

WhichCCI( 1 ), // 1 = Regular, 2 = Fast, 3 = Smoothed, 4 = Smoothed fast

DrawText( True ), // If set to true, text is drawn on cart but pattern highlights are not. If false text is not drawn on cart but pattern highlights are

LowerLine( -100 ), // Used to draw horizontal line at the user input level

UpperLine( 100 ), // Used to draw horizontal line at the user input level

ChosenCCICol( White ), // Color of chosen CCI

CCIColor( DarkGray ), // If ‘legacy’ CCI drawn, specify its color

ShowRegularCCI( TRUE ), // If TRUE ‘legacy’ CCI drawn

CCIFastColor( Red ), // Color of fast smoothed CCI

SmoothCCIColor( Cyan ), // Color of smoothed CCI

SmoothFastCCIColor( Magenta ), // Color of smoothed fast CCI

HorizLines( DarkGray ), // Color of horizontal lines

BearishCol( Red ), // Color of bearish zero rejection

BullishCol( Green ), // Color of bullish zero rejection

TextColor( White ), // Text color

CCILength( 14 ), // CCI length

FastLength( 6 ), // Length of ‘fast’ CCI

SmoothLength( 14 ), // Factor used to smooth CCI

FastSmoothLength( 14 ); // Factor used to smooth fast CCI

The unprotected EasyLanguage indicator and protected smoothed CCI function are available for immediate download for $29.95 by clicking the ‘add to cart’ button. You can pay with credit card or PayPal.

As usual, Gold Pass members get an additional 20% discount off all program and tutorial prices. If you are a Gold Pass member make sure you enter the special coupon code to get 20% discount off these prices.

Please note that any screen shots on this site are examples and are not meant to imply that any of these programs will generate profitable trades. THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.