Tradestation users often wonder why the performance of a strategy is one thing, but when adjusting the Look-inside-bar-back-test and Intra bar order generation and calculation the performance can be radically different. Tutorial 147 seeks to demonstrate the differences to strategy bar data when Look-inside-bar-back-test and Intra bar order generation and calculation are selected. To do so the tutorial uses a very simple moving average cross-over strategy. The demonstration program and workspace (for TradeStation 9.5 and 10) may be downloaded by Gold Pass members at no cost (see below).

The following short video shows some of the differences:

Video demonstration of tutorial 147

Tutorial 147 uses the following print statement to show the moving average values, whether crossovers have occurred and the market position for each tick:

//If GetAppInfo( aiRealTimeCalc ) = 1 and BarInterval = 1 then // Real time bars and 1 minute bar //If GetAppInfo( aiRealTimeCalc ) = 0 and BarInterval = 1 then // Historic bars and 1 minute bar //If GetAppInfo( aiRealTimeCalc ) = 1 and BarInterval = 2 then // Real time bars and 2 minute bar //If GetAppInfo( aiRealTimeCalc ) = 0 and BarInterval = 2 then // Historic bars and 2 minute bar If GetAppInfo( aiRealTimeCalc ) = 1 and BarInterval = 3 then // Real time bars and 3 minute bar //If GetAppInfo( aiRealTimeCalc ) = 0 and BarInterval = 3 then // Historic bars and 3 minute bar Print( Barinterval," ",D, T, " MovAv1 ", MovAv1," MovAv2 ", MovAv2," MovAv1 crosses above MovAv2 ",MovAv1 crosses above MovAv2, " MovAv1 crosses below MovAv2 ",MovAv1 crosses below MovAv2, " MP ", MarketPosition( 0 ) );

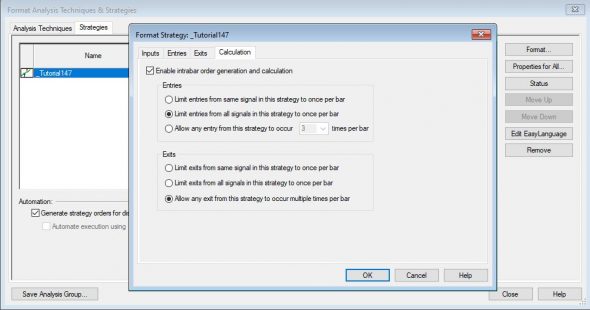

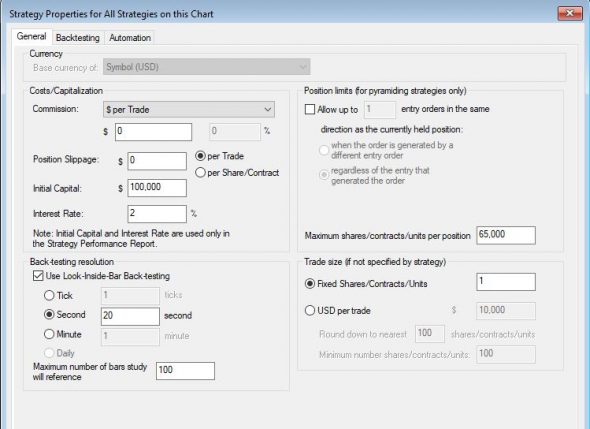

In this tutorial the options are selected using the following dialogs:

- Look-inside-bar-backtesting OFF, Enable intra bar order generation and calculation OFF Look-inside-bar-backtesting OFF,

- Enable intra bar order generation and calculation ON, Look-inside-bar-backtesting ON,

- Enable intra bar order generation and calculation ON

The tutorial 147 program and workspace (for TradeStation 9.5 and TradeStation 10.0) are available for free download for Gold Pass members (see below).

Inputs

double Price( C ), // Price used in moving average calculation

int Len1( 5 ), // Length of fast moving average

int Len2( 14 ); // Length of slow moving average

Gold Pass download area (make sure you are logged in)

Please email if you find any bugs,notice any errors, or have questions about the tutorial.

THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.