Program 39 uses the Price Series Provider to calculate and plot stochastic oSlowD for eleven symbols. The program works on intra-day bars and daily charts and was developed in TradeStation 9.0.

The examples below are based on FOREX symbols, but it will also work with futures or equities.

The advantage of using the Price Series Provider is that the indicator can be applied to one specific symbol while providing stochastic information about others. The same result could be achieved by using multiple data streams but the time taken to set up the chart is much longer.

The program is unprotected so you can potentially modify it to use other analysis techniques or use it as a model for your own indicator.

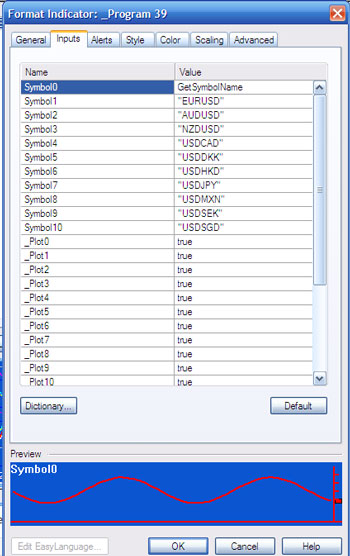

The user defines the symbols to be analyzed by entering symbol names in the program inputs (see below).

The UNPROTECTED program (i.e. TradeStation EasyLanguage indicator) DEVELOPED IN VERSION 9.0 of TradeStation are available for immediate download for $59.95. Click the ‘add to cart’ button to pay using Credit card or PayPal. Gold Pass members are eligible for 20% off this price when they type in their special discount code (see //markplex.com/gold-pass-content/ to get the latest code).

The symbols are entered in quotes, e.g. “GBPUSD.” The symbol does not have to include the symbol of the chart that the indicator is applied to, however, to include the symbol for the chart one of the inputs can be made GetSymbolName.

In this example I have used Forex symbols, any valid symbol can be used (provided to subscribe to the relevant data feed). The additional symbols are assumed to have the same bar length as the chart to which the indicator is applied.

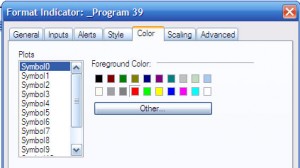

The user may also determine whether a plot is drawn for a particular symbol by using the _Plot0 to _Plot10 inputs. So, assuming the indicator were applied a chart with the same symbol inputs as those in the image to the right, if _Plot1 were set to true and _Plot2 were set to false then the oSlowD would be plotted for EURUSD but would not be plotted for AUDUSD.

The other inputs are StochLength, SmoothingLength1, SmoothingLength2, SmoothingType, OverSold, and OverBought.

User inputs

string Symbol0( “GBPUSD” ), // Symbol name-make sure it is in quotes

string Symbol1( “EURUSD” ), // Symbol name-make sure it is in quotes

string Symbol2( “AUDUSD” ), // Symbol name-make sure it is in quotes

string Symbol3( “NZDUSD” ), // Symbol name-make sure it is in quotes

string Symbol4( “USDCAD” ), // Symbol name-make sure it is in quotes

string Symbol5( “USDDKK” ), // Symbol name-make sure it is in quotes

string Symbol6( “USDHKD” ), // Symbol name-make sure it is in quotes

string Symbol7( “USDJPY” ), // Symbol name-make sure it is in quotes

string Symbol8( “USDMXN” ), // Symbol name-make sure it is in quotes

string Symbol9( “USDSEK” ), // Symbol name-make sure it is in quotes

string Symbol10( “USDSGD” ), // Symbol name-make sure it is in quotes

bool _Plot0( True ), // If TRUE plot stochastic for Symbol0

bool _Plot1( True ), // If TRUE plot stochastic for Symbol1

bool _Plot2( True ), // If TRUE plot stochastic for Symbol2

bool _Plot3( True ), // If TRUE plot stochastic for Symbol3

bool _Plot4( True ), // If TRUE plot stochastic for Symbol4

bool _Plot5( True ), // If TRUE plot stochastic for Symbol5

bool _Plot6( True ), // If TRUE plot stochastic for Symbol6

bool _Plot7( True ), // If TRUE plot stochastic for Symbol7

bool _Plot8( True ), // If TRUE plot stochastic for Symbol8

bool _Plot9( True ), // If TRUE plot stochastic for Symbol9

bool _Plot10( True ), // If TRUE plot stochastic for Symbol10

int StochLength( 14 ),

int SmoothingLength1( 3 ),

int SmoothingLength2( 3 ),

int SmoothingType( 1 ), // 1 for Original, 2 for Legacy

double OverSold( 20 ),

double OverBought( 80 ) ;

Video explaining program 39

The UNPROTECTED program (i.e. TradeStation EasyLanguage indicator) DEVELOPED IN VERSION 9.0 of TradeStation are available for immediate download for $59.95. Click the ‘add to cart’ button to pay using Credit card or PayPal. Gold Pass members are eligible for 20% off this price when they type in their special discount code (see //markplex.com/gold-pass-content/ to get the latest code).

Please note that any screen shots on this site are examples and are not meant to imply that any of these programs will generate profitable trades. THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.