Multi-oscillator divergence

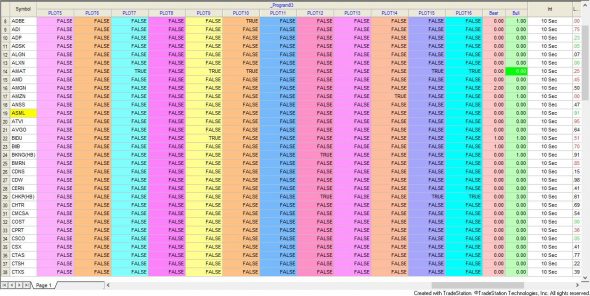

_Program 83, designed for TradeStation RadarScreen and Scanner, looks for regular bullish and bearish divergences between a price and each of sixteen oscillators (see the names of the oscillators below). The number of oscillators for which there is bullish divergence for each bar is summed. The number of oscillators for which there is bearish divergence is also summed and the two sums are plotted in Radarscreen and available within TradeStation Scanner.

When _Program83 is used in Radarscreen, if the number of bullish divergences exceeds the user input: BullThreshold then the background color of the bullish count plot is turned green. If the number of bearish divergences exceeds the user input: BearThreshold then the background color of the bearish count plot is changed to red. If Alerts are enabled the program also generates alerts when the thresholds are exceeded.

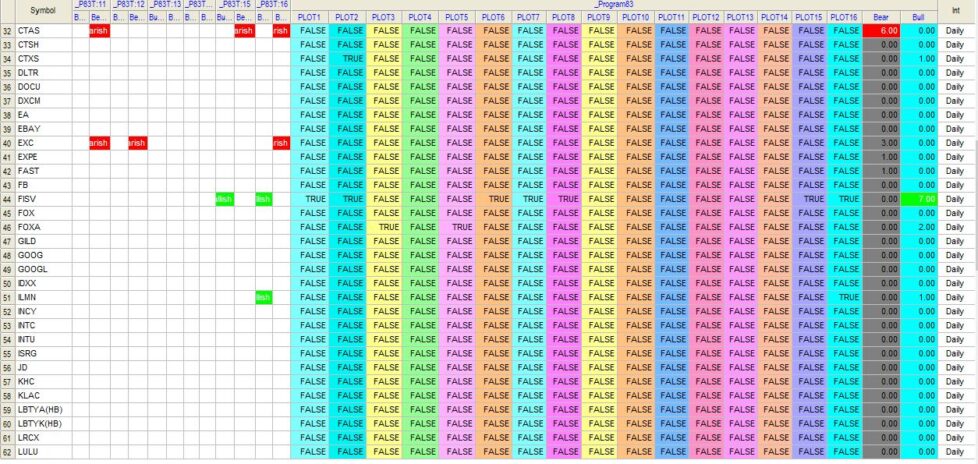

The companion program, _Program83-tester (based on program 62) was created to help test and verify whether _Program 83 was functioning as expected during the development process. This additional program (included in the download) is not necessary to run _Program 83 but it does provide additional useful functionality. For example, _Program83-tester will indicate if a divergence with a specific oscillator has occurred. It can also be used to give a visual indication of a divergence on a chart for a specific oscillator. In Radarscreen it plots whether there is bullish and/or bearish divergence between price and an individual oscillator selected by the user.

Video demonstration of program 83

On a chart _Program83-tester plots the oscillator selected by the user in a subgraph. When a potential divergence is found a line is drawn between price pivots corresponding to pivots in the oscillator.

Since price and the oscillator pivots do not necessarily occur on exactly the same bar, the program has a user input (BarTol) to determine how many bars apart the price pivot and the stochastic pivot can occur to still be considered a price/oscillator pivot pair. The price pivot can occur before the oscillator pivot, or vice versa.

Also used in the testing process and included within _Program83, but commented out, are additional plot statements that show whether there is divergence for each of the 16 oscillators. I demonstrate the test program in the video below.

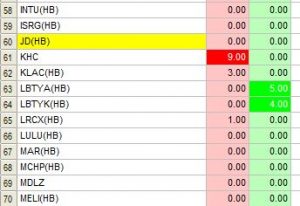

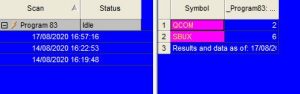

_Program83 also works in the TradeStation Scanner. In this image a universe of symbols was scanned to find a number of divergences above a certain number.

_Program83 also works in the TradeStation Scanner. In this image a universe of symbols was scanned to find a number of divergences above a certain number.

The program, written for TradeStation 9.5 and works with 10.0. and higher. In Radarscreen _Program83 can be used with tick, second, minute, daily, weekly and monthly bars. With the Scanner it can also be used with volume bars. The amount of processing resources required increases with the number of symbols and the smaller the bar length. This program does not work with MultiCharts.

Oscillator options

| WhichOsc user input values | Oscillator | Oscillator sub option |

|---|---|---|

| 1 | Stochastic | oFastK |

| 2 | Stochastic | oFastD |

| 3 | Stochastic | oSlowD |

| 4 | MACD | MACD |

| 5 | MACD | MACD average |

| 6 | MACD | MACD difference |

| 7 | RSI | RSI |

| 8 | RSI | RSI average |

| 9 | CCI | CCI |

| 10 | CCI | Fast CCI |

| 11 | CCI | Smoothed CCI |

| 12 | CCI | Smoothed fast CCI |

| 13 | TSI | TSI |

| 14 | TSI | TSI average |

| 15 | Stochastic of RSI | StochRSI |

| 16 | Stochastic of RSI | SmoothSRSI |

Program download

Program 83 was developed for TradeStation 9.5 and 10.0.

An UNPROTECTED programs (TradeStation EasyLanguage indicators: _Program83 and _Program83-tester) are available for for immediate download for $275- by clicking the ‘add to cart’ button. Because this version is unprotected you can open it, see the program code and modify it.

If you are a Gold Pass member make sure you enter the special coupon code to get 20% discount off these prices. Log into Gold pass and then click here to see the latest code. This code should be entered into the shopping cart to automatically deduct the discount.

_Program83 may be applied to RadarScreen, and/or the scanner. It also includes alert functionality which may be controlled by the indicator settings.

_Program83-tester may be applied to charts, RadarScreen, and/or the scanner.

Inputs

The word before the input name is the data type as follows:

- int = integer (i.e. 0, 1, 2, 3 )

- bool = boolean (i.e. true or false)

- double = double(i.e. 2.34236)

- string = string (i.e. “words”)

After the input names is a brief explanation of its use. The ‘//’ tells the program that the words are comments and they do not affect the running of the program.

The number contained within parentheses is the default value for the user input. This means that the program will run with this value unless you change it.

Input values for _Program83

int MaxArraySize( 5), // Maximum = 5. Determines how many previous pivots are compared each time a new price pivot and corresponding Stochastic pivot are discovered

int BearThreshold( 5 ), // Change color of Radarscreen cell when CountBearDiv is above this value

int BullThreshold( 5 ), // // Change color of Radarscreen cell when CountBullDiv is above this value

// Pivot inputs

int LeftStrength( 3), // Left strength of pivots

int RightStrength( 2), // Right strength of pivots

int BarTol( 3), // The number of bars within which the price and Stochastic pivot must occur for the pivots to be considered to have occurred on the same bar

// Price inputs for all the oscillators

double OscPriceH( High), // High price input for oscillator calculations

double OscPriceL( Low), // Low price input for oscillator calculations

double OscPriceC( Close), // Closing price input for oscillator calculations

// Stochastic inputs

int StochLength( 14), // Input to stochastic calculation

int StochLength1( 3), // Used to slow FastK to FastD = SlowK

int StochLength2( 3), // Used to slow FastD to SlowD

int StochSmoothType( 1), // StochSmoothType = 1 for Original, StochSmoothType = 2 for Legacy }

// MACD inputs

double MACDPrice( Close), // Input to MACD

int MACDLength( 9), // Input to MACD

int MACDFastLength( 16), // Input to MACD

int MACDSlowLength( 26), // Input to MACD

// TSI inputs

double TSIPrice( Close), // Input to True Strength Index calculation

int TSIPeriod1( 25), // Input to True Strength Index calculation

int TSIPeriod2( 13), // Input to True Strength Index calculation

int TSIPeriod3( 5), // Input to True Strength Index calculation

// RSI inputs

double RSIPrice( Close), // Used in RSI calculation

int RSILength1( 10), // Used in RSI calculation

int RSILength2( 5), // Used in Exponential moving average of RSI calculation

// CCI inputs

int CCILength( 14), // CCI length

int CCIFastLength( 6), // Length of ‘fast’ CCI

int CCISmoothLength( 14), // Factor used to smooth CCI

int FastCCISmoothLength( 14), // Factor used to smooth fast CCI

// Stochastic of RSI

double SRSIPrice( Close), // Price input to SRSI calculation

int SRLength( 14), // Length used in the RSI calculation

int SRSISmoothLength( 5); // Smoothing length used to smooth the stochastic of the RSI

Input values for _Program83-tester

Inputs for the tester program are almost the same except for:

int WhichOsc( 1), // Determines which oscillator the program uses to test for divergence

// Trendline attributes

bool DrawTL( True),

int TLWeight( 3), // Determines the thickness oof the trendline. Valid numbers are integers between 0 and 6

int TLStyle( 0), // 0 = solid, 1 = dashed, 2 = dotted, 3 = dashed2, 4 = dashed3

int TLTransparency( 255), // Sets the alpha component (transparency) of this color structure, where 0 is fully transparent and 255 is fully opaque

string LowerColor( “Green”), // Color of lines indicating possible bullish divergence

string UpperColor( “Red”), // Color of lines indicating possible bearish divergence

// Ellipse attributes

bool DrawEllipse( True),

int EWeight( 3), // Must equal 0, 1, 2, 3, or 4

string FillColor( “Yellow”), // Fill color of the ellipse

string BorderColor( “Orange”), // Border color of the ellipse

The trendline and ellipse inputs refer to the divergence lines drawn on the chart by _Program83-tester.

Available Colors

| AliceBlue | DarkSlateGray | LightSalmon | PaleVioletRed |

| AntiqueWhite | DarkTurquoise | LightSeaGreen | PapayaWhip |

| Aqua | DarkViolet | LightSkyBlue | PeachPuff |

| Aquamarine | DeepPink | LightSlateGray | Peru |

| Azure | DeepSkyBlue | LightSteelBlue | Pink |

| Beige | DimGray | LightYellow | Plum |

| Bisque | DodgerBlue | Lime | PowderBlue |

| Black | Firebrick | LimeGreen | Purple |

| BlanchedAlmond | FloralWhite | Linen | Red |

| Blue | ForestGreen | Magenta | RosyBrown |

| BlueViolet | Fuschia | Maroon | RoyalBlue |

| Brown | Gainsboro | MediumAquamarine | SaddleBrown |

| Burlywood | GhostWhite | MediumBlue | Salmon |

| CadetBlue | Gold | MediumOrchid | SandyBrown |

| Chartreuse | Goldenrod | MediumPurple | SeaGreen |

| Chocolate | Gray | MediumSeaGreen | Seashell |

| Coral | Green | MediumSlateBlue | Sienna |

| CornflowerBlue | GreenYellow | MediumSpringGreen | Silver |

| Cornsilk | Honeydew | MediumTurquoise | SkyBlue |

| Cyan | HotPink | MediumVioletRed | SlateBlue |

| DarkBlue | IndianRed | MidnightBlue | SlateGray |

| DarkBrown | Indigo | MintCream | Snow |

| DarkCyan | Ivory | MistyRose | SpringGreen |

| DarkGoldenrod | Khaki | Moccasin | SteelBlue |

| DarkGray | Lavender | NavajoWhite | Tan |

| DarkGreen | LavenderBlush | Navy | Teal |

| DarkKhaki | LawnGreen | OldLace | Thistle |

| Dark Magenta | LemonChiffon | Olive | Tomato |

| DarkOliveGreen | LightBlue | OliveDrab | Turquoise |

| DarkOrange | LightCoral | Orange | Violet |

| DarkOrchid | LightCyan | OrangeRed | Wheat |

| DarkRed | LightGoldenrodYellow | Orchid | White |

| DarkSalmon | LightGray | PaleGoldenrod | WhiteSmoke |

| DarkSeaGreen | LightGreen | PaleGreen | Yellow |

| DarkSlateBlue | LightPink | PaleTurquoise | YellowGreen |

Summary of the oscillators

Relative strength index (RSI)

The relative strength index (RSI) was developed by J. Welles Wilder and is a momentum oscillator that measures the speed and change of price movements. It oscillates between zero and 100.

Moving average convergence divergence (MACD)

The moving average convergence divergence (MACD) returns the difference between a fast and slow exponential moving average based on the same price.

Stochastic

The stochastic oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. It follows the momentum of price.

True strength index (TSI)

The true strength index (TSI) is a momentum-based indicator, originally developed by William Blau. It is used to find the trend and overbought/oversold conditions.

Commodity channel index (CCI)

The commodity channel index (CCI) is an oscillator introduced by Donald Lambert in 1980. It is calculated as the difference between the typical price of a commodity and its simple moving average, divided by the mean absolute deviation of the typical price. In TradeStation the index is scaled by an inverse factor of 0.015.

Stochastic of RSI

The stochastic of the RSI is calculated using the following formula:

TrueStrengthIndex = 100 * _Divide( XAverage( XAverage( Price – Price[1], TSIPeriod1 ), TSIPeriod2 ), XAverage( XAverage( AbsValue( Price – Price[1] ), TSIPeriod1 ), TSIPeriod2 ) );

XAvgTSI = XAverage( TrueStrengthIndex, TSIPeriod3 );

_Divide is a function that divides the first input by the second, while checking for divide by zero errors.

Please note that any screen shots on this site are examples and are not meant to imply that any of these programs will generate profitable trades. THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.