How to create a form to send OCO (Order Cancels Order) and OSO (Order Sends Order) order tickets

In tutorial 134 I responded to a Gold Pass member who asked whether it is possible to create a program that processes textual information (formatted in a specific way), generated using a spreadsheet, that describes a list of trades. He envisaged pasting this textual information into an EasyLanguage program (using the TradeStation Development Environment) that could then be verified and applied to a chart to send order tickets to the market.

In this new tutorial I demonstrate how to send similar information, but this time using a form. It may be useful to familiarize yourself with the tutorial 134 videos before looking at this tutorial.

The indicator is designed to be applied once to one chart in your TradeStation environment.

As with tutorial 134, I have deliberately kept the program as simple as possible without adding additional providers to add other ‘bells and whistles’ to flag the activities of the order tickets.

[toggle title=”Introduction to OCO (Order Cancels Order) and OSO (Order Sends Order) orders” variation=”orange”]An OSO order sends one or more orders (secondary orders) to the market once a trade entry order (the primary order) is filled. An OCO allows several orders (siblings in EasyLanguage parlance) to be sent to the market at the same time. When one of these orders is filled, the other orders in the group are automatically canceled.[/toggle]

Inputs and data settings

The tutorial program has the following input:

string iAccount1( “” )

Enter your simulated trading account number (it will begin with ‘SIM’) relevant to the symbol that you would like to test with.

- Creating and editing a simple form

- Creating a button click event

- Access text submitted in the form

- How to clear the form

- Calling a method (created in tutorial 134) to create Order Tickets

- Using StreamWriter and StreamReader

- Using TokenList to separate comma delimited text into a vector

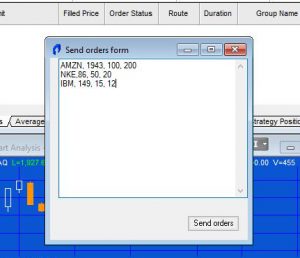

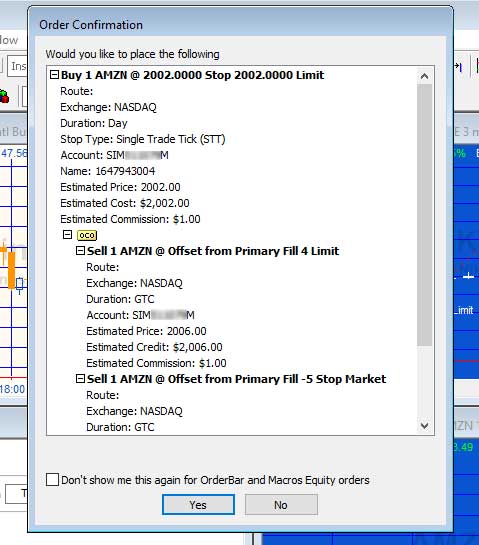

The tutorial program puts the syntax for three order tickets (entry, target and stop), an OCO order ticket (used so that if the target is reached first, the stop order ticket is cancelled and vice versa) and an OSO order ticket that sends the OCO order when the entry order is sent. The syntax to create the order tickets is placed in a method (SetUpOrder) which is called once on a real time tick.

The syntax for calling the method is:

SetUpOrder( Symbol name in doubles quotes, entry price, target offset from entry price, stop offset from entry price )

for example:

SetUpOrder( "AMZN", 1946, 100, 200 ); SetUpOrder( "NKE", 84, 50, 20 ); SetUpOrder( "IBM", 146, 15, 12 );

Download

Video explanation of Tutorial 135

Please let me know if you notice any mistakes or errors or have questions.

THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.