Welcome to tutorial 14 in this series of tutorials designed to explain TradeStation EasyLanguage concepts. If you learn the TradeStation EasyLanguage yourself, you will have a skill that will enable you to program and try out trading ideas. As always, the purpose of this tutorial is to demonstrate the programming techniques as opposed to creating a tradeable indicator. The tutorial assumes you are using TradeStation version 8.1 or above.

In this tutorial we will create a simple ShowMe study that displays when a bearish or bullish engulfing pattern occurs. The initial program we create will be modified so that when such a pattern occurs the program will send an e-mail.

Step 1

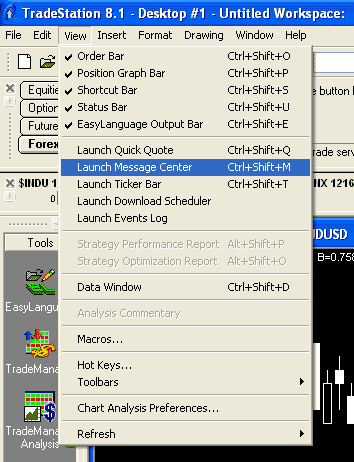

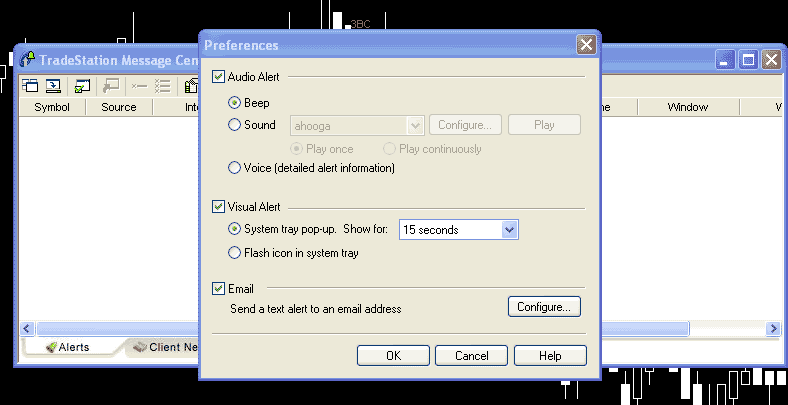

In order to allow your TradeStation installation to be able to send e-mail messages, it needs to be configured correctly. Open TradeStation and on the top menu bar click on View – Launch message Center (see screen grab below).

Step 2

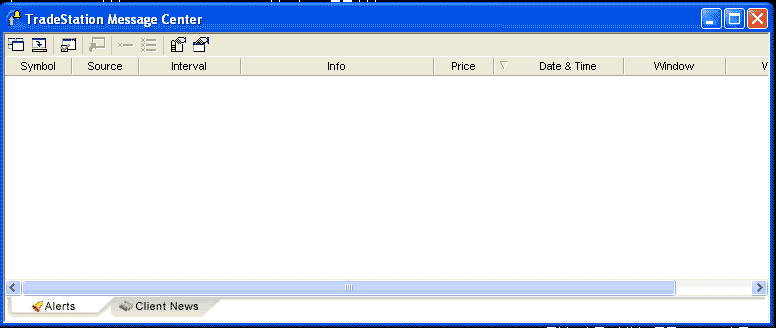

This will bring up the TradeStation Message Center (see below).

You will notice several button at the top of the message center. Click the third button from the left.

Step 3

A preference windows will appear (see below).

Click the e-mail check-box and press the configure button.

Step 4

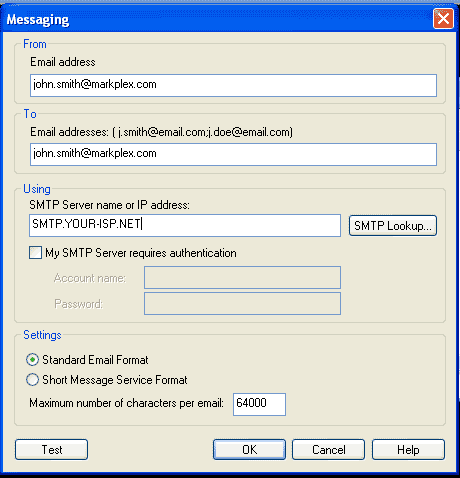

IMPORTANT: If this step is not completed correctly, your program will not send e-mails

In the messaging box, enter your e-mail address and the e-mail to which you want the e-mails to be sent.

The SMTP server is that server that you use to send e-mails (for example, in your e-mail client). It will be something like SMTP.YOUR-ISP.NET. If you don’t know the name of your SMTP server, open your e-mail client (i.e. Outlook Express, Outlook, Eudora or Mozilla Thunderbird) and review your settings. You could also try searching for SMTP in the help function of your e-mail client. Also note whether your SMTP server requires authentication (in other words, a user name and password).

Enter the SMTP sever name and click the ‘My SMTP Server requires authentication’ check-box if your SMTP server needs a user name and password.

Step 5

In order to demonstrate the e-mail capabilities of TradeStation we are going to create a very simple Show-Me study based on a particular candlestick pattern. This program does not send e-mails – we will add this functionality later.

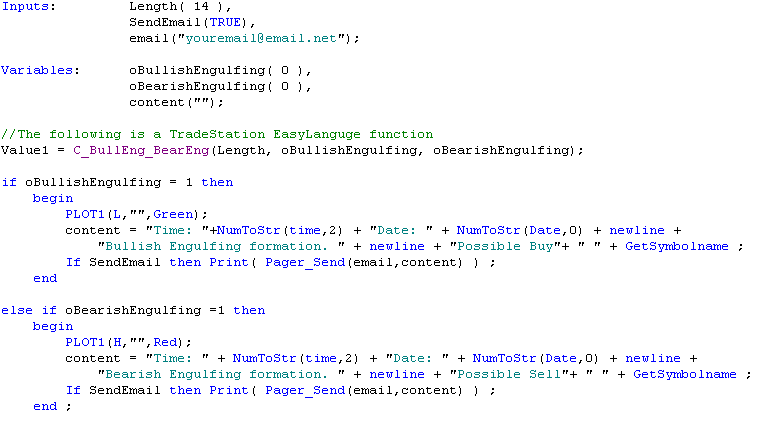

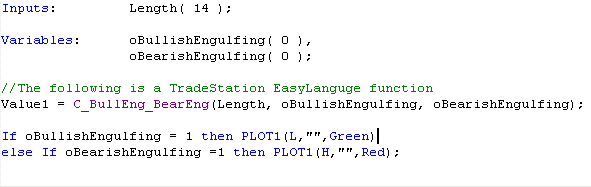

Click File – New – Window and create a new Show-me study. Enter the following program:

The ShowMe study uses TradeStation’s C_BullEnd_BearEng function to look for Bullish and Bearish engulfing patterns. The function returns a value of 1 in the oBullishEngulfing variable if there is a bullish pattern and a value of 1 in the oBearishEngulfing variable if there is a bearish pattern. The show me plots a green dot if oBullishEngulfing = 1 and a red dot if oBearishEngulfing = 1.

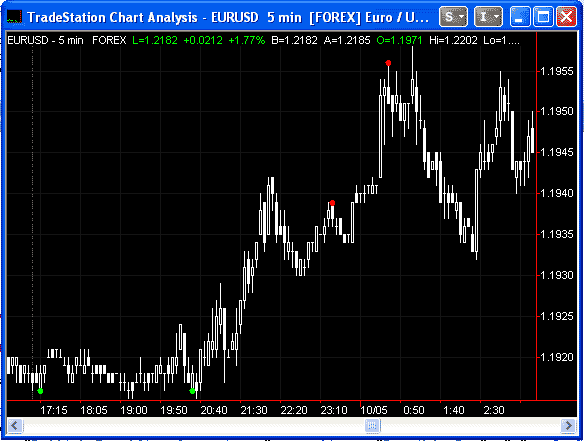

After entering the code, validate it (press F3) and then insert it into a chart. See below for example:

Make sure that there are some instances of the pattern, otherwise no e-mails will be sent as we develop the program further. If not try changing the timescale or symbol.

Step 6

WARNING: The default behavior of TradeStation is to update intrabar. This means that if a condition (for example oBullishEngulfing = 1) is fulfilled on the current bar, then TradeStation will send an e-mail every tick. In other words your e-mail box can get very full very quickly! For testing purposes, you might try changing the status of the show-me to on and then to off. This will ensure that it will not send yourself hundreds of e-mails.

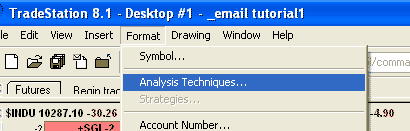

You can also make the indicator only update only once per bar as follows. Click Format – Analysis Techniques.

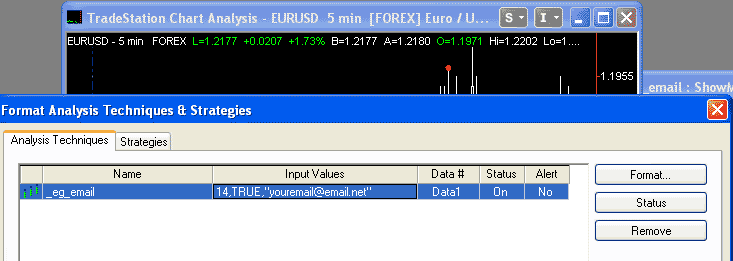

Double click on your Show-Me study:

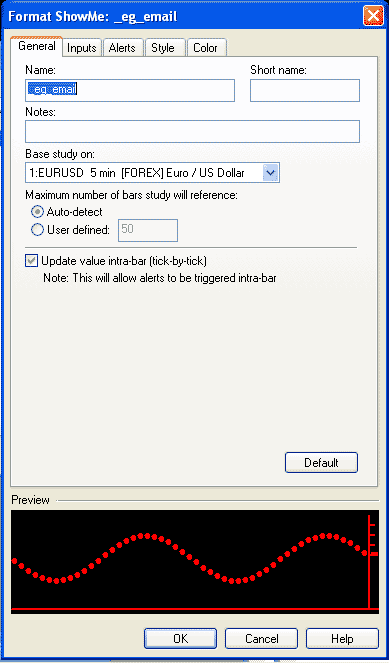

Select the General tab and un-click the ‘Update value intrabar (tick-by-tick).’

Step 7

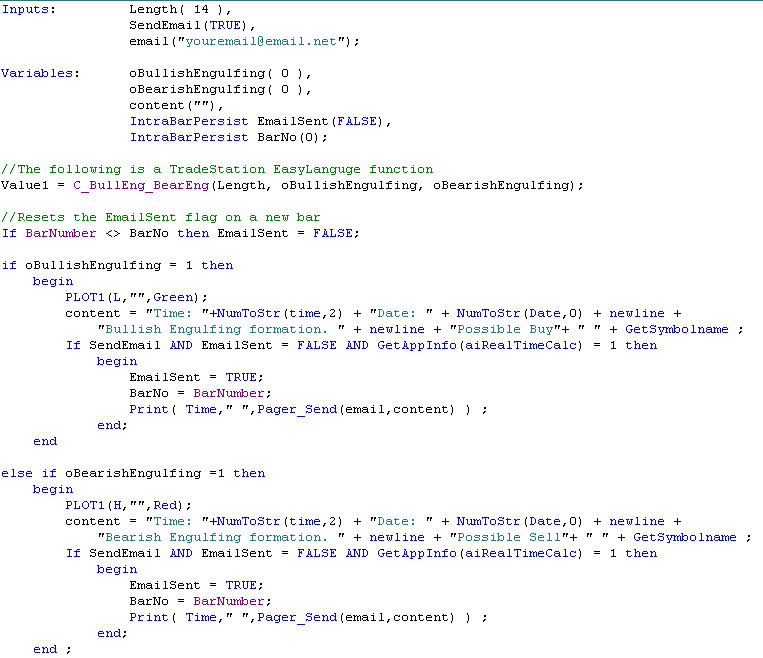

In order to get the program to send e-mails we need to add a few additional lines of code. Modify the program that you have already created so that it is the same as below:

This new version includes a content variable. This is the ‘content’ of the e-mail that you will receive. Notice that you can send text enclosed in quotes. You can also send variable values – but you have to convert them to ‘strings’ (words) first, This is done using the NumToStr function as I have done in the example. To create a new line in the e-mail add + newline + between text items.

The actual command to send the e-mail is Pager_Send(email,content). I have enclose this within the Print command, thus: Print(Pager_Send(email,content)). This will send the e-mail and print the return value (either TRUE or FALSE).

We have also created an input : SendEmail. This can be modified by the user to determine whether the program sends e-mails or not.

If you run this program, you will notice that it goes through all the historical occurrences of the candlestick formation and sends you an e-mail each time they occur. You may wish your program to perform in this way, however if we only want the program to send e-mails as conditions occur in the present we need to modify the program.

In addition, we will add some functionality to ensure that e-mails are only sent once per bar, irrespective of whether the ‘Update value intrabar (tick-by-tick)’ check box is selected or not.

Step 8

Modify the program as follows:

If you examine the code, you will see several changes.

I added GetAppInfo( aiRealTimeCalc ) = 1 to the test of whether to send the e-mail. This only allows e-mails to be sent in ‘real-time’ – no historic e-mails.

A further change I made was to create a variable: EmailSent. Once an e-mail has been sent, this variable is set to TRUE. Before another e-mail is sent the value must be equal to FALSE. To turn the EmailSent variable back to false, I store the BarNumber of the bar when the e-mail is sent in the BarNo variable . Every tick, the program tests whether the current bar number is greater than the one on which the e-email was sent. If it is, we have reached a new bar and the EmailSent variable is changed back to FALSE.

IMPORTANT: for this functionality to work, the variables EmailSent and BarNo must be evaluated intrabar (rather than just at the end of the bar). To make the program do this we add a modifier to the variable declaration as follows:

IntraBarPersist EmailSent(FALSE),

IntraBarPersist BarNo(0)

Step 9

Verify the program and check your e-mail client in-box.

If you see any errors in this tutorial – or I have not made something clear, please e-mail: tutorials@markplex.com. Also, let me know if you have any ideas for new tutorials.

Summary

This tutorial demonstrates TradeStation’s capability of sending e-mails. The example is trivial but the method can be applied to far more complex situations.

If you have any questions about the above material or you would like to point out a correction or typo, please e-mail: tutorials@markplex.com. Also e-mail if you have any ideas for future tutorials.

Copy the tutorial 14 TradeStation EasyLanguage code for Gold Pass members

If you are a Gold Pass member you can copy the tutorial code below, please make sure that you are logged in with your Gold Pass user name and password.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.