Tutorial 162 is a new tutorial that demonstrates how to create a Showme study that uses the Option Chain Provider (OCP) and the Quotes Provider (QP) objects.

A method calls the OCP to find options for the stock symbol that is applied to the chart.

After creating the OCP, the tutorial program calls the QP to create a quote object for each of the option symbols in the option chain. For each quote, two update events are set up, one for put options and the other for call options.

After creating the OCP, the tutorial program calls the QP to create a quote object for each of the option symbols in the option chain. For each quote, two update events are set up, one for put options and the other for call options.

Each time the update is fired the program retrieves the strike price and the trade volume for the option that was updated. It updates a dictionary with the highest trade volume for each strike price for the bar being calculated. Calls and puts are processed separately.

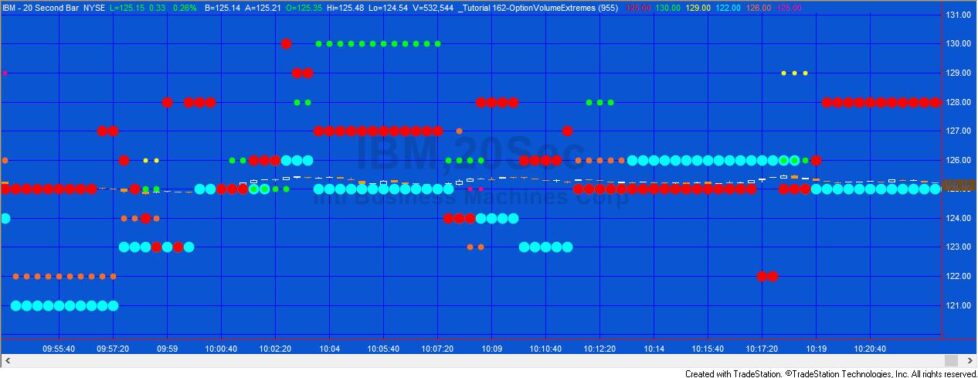

The program constantly sorts a vector of the trade volumes and determines the strike prices with the highest trade volume, the second highest trade volume and the third highest trade volume for the bar in progress. The top three strike prices, by volume, are plotted for calls and the top three values are plotted for puts.

The program constantly sorts a vector of the trade volumes and determines the strike prices with the highest trade volume, the second highest trade volume and the third highest trade volume for the bar in progress. The top three strike prices, by volume, are plotted for calls and the top three values are plotted for puts.

Walk-through of Tutorial 162

Download the tutorial 162 tutorial Showme study (_Tutorial 162-OptionVolumeExtremes)

The show-me is unprotected, in other words, you will be able to see, modify and experiment with the tutorial’s code.

THE TRADING APPS, INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, TRADING APPS, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.