Tutorial 184 is based on the Markplex SuperTrend indicator which is a stop and reverse (SAR) indicator that trails price action See the original indicator: tutorial 173 here.

This implementation calculates the Average True Range (ATR) of the average price using the exponential moving average. A user input multiple of the ATR is added to or subtracted from the average price to give Upper and Lwr respectively, depending on the direction. Direction is determined by the Close of a bar relative to the value of the SuperTrend, Upper and Lwr using the following code:

If C > SupTrend and C > Lwr then Dir = 1

else if C < SupTrend and C < Upper then Dir = -1;

When the direction is up (Dir = 1), the SupTrend value can only increase. When the direction is down, the SupTrend can only decrease.

There are many different interpretations of the so-called SuperTrend indicator. In this Markplex version the SuperTrend value is also tightened (i.e. moved closer to price) by using an acceleration factor which increases incrementally each bar by user input: AFStep up to a a maximum value of user input: MaxAF.

In addition a ‘Supertrend’ exit is calculated (SupTrendExit). The value of this is set to the value of SupTrend when direction changes and is then calculated using:

SupTrendExit = MaxList( SupTrendExit, L - ( ( L - SupTrendExit ) * ( 1 - AFExit ) ) )

when Dir = 1, otherwise by:

SupTrendExit = MinList( SupTrendExit, H + ( SupTrendExit - H ) * ( 1 - AFExit ) )

A buy market order is generated when Dir changes from -1 to 1, provided that LongFilter1, LongFilter2 and LongFilter3 all evaluate to true and the program is not currently in a trade.

A sell short market order is generated when Dir changes from 1 to -1, provide that ShortFilter1, ShortFilter2 and ShortFilter3 all evaluate to true and the program is not currently in a trade.

When in a long position and the close crosses under SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. Similarly, when in a short position and the close goes above SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. The user could experiment with replacing this functionality will other types of stop, for example a trailing stop.

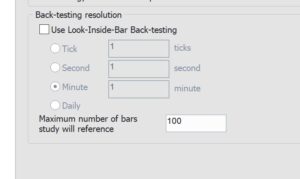

The tutorial gives an example of LongFilter1 and ShortFilter1 using an implementation of the Moving Average Gap Ratio. If this is used, the user will need to change the strategies’ “Maximum Number of Bars Study will reference” to be equal to the value of SlowLength. The user can experiment with replacing this filter with their own as the strategy tends to get ‘whipsawed’ in non-trending markets.

The tutorial gives an example of LongFilter1 and ShortFilter1 using an implementation of the Moving Average Gap Ratio. If this is used, the user will need to change the strategies’ “Maximum Number of Bars Study will reference” to be equal to the value of SlowLength. The user can experiment with replacing this filter with their own as the strategy tends to get ‘whipsawed’ in non-trending markets.

To use this strategy make sure that “Enable intrabar order generation and calculation” is not selected.

Tutorial 184 (indicator and strategy) applied to a chart

Video explaining tutorial 184

The programs work in TradeStation and MultiCharts.

Installation of tutorial 184 | TradeStation 10

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.