Welcome to tutorial 23 in this series of tutorials to help you learn TradeStation EasyLanguage programming skills. The purpose of these video tutorials is to demonstrate the programming techniques rather than to create a ‘tradeable’ indicator. This tutorial was created using TradeStation version 8.6.

This video tutorial talks through the creation of an indicator to ‘mimic’ the behavior of a three line break chart.

The resulting screen should look something like:

Line break charts

Line breaks charts ignore time. New up lines are only added when a bar closes higher than the high of the previous up line. Once up lines are being drawn price has to go below the low of a specified number of up lines in order to create a new down line. New down lines are only added when a bar closes below than the low of the previous down line. Once down lines are being drawn price has to go above the high of a specified number of down lines in order to create a new up line.

Please note:

I recommend that, when running this program, you uncheck “Update Value Intra-Bar” by clicking Format – Analysis Techniques (select this indicator), click the format button on the right and uncheck “Update Value Intra-Bar (tick by tick)”.

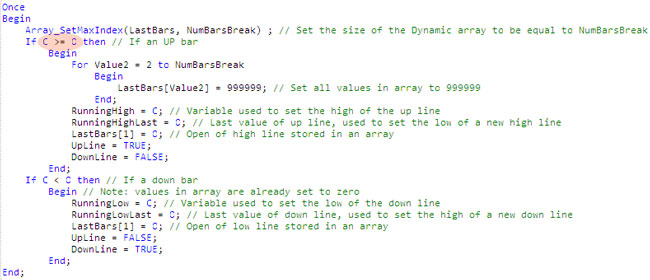

The tutorial, as explained in videos part 1, part 2 and part 3, contains a ‘feature’ that means that if the indicator is applied to a chart where the first bar evaluated has Close equal to Open, then nothing is plotted. In order to ensure that the indicator plots even when the first bar evaluated has Close equal to Open, the program needs to be modified as in the image below, i.e. by adding an equals sign into the first inequality, thus C >= O. This means that if Close is equal to Open, we designate that it is an up bar (even though it isn’t really) and the program goes from there.

I have posted a part 4 video below, which explains this in more detail.

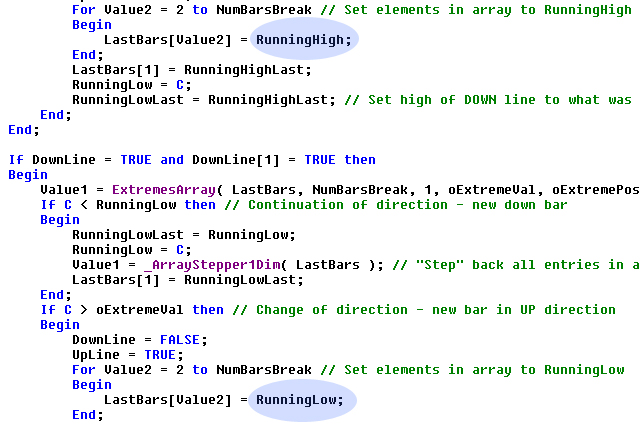

Since releasing this tutorial, I corrected an additional bug that was making some reversals incorrect. The downloadable file has been updated. The changes that have been made can be seen on the screen print below:

Additional images of tutorial 23 applied to @YM and @NQ charts (click to see larger images):

If you have the typing stamina you can enter the following (or for $29.95 you may click the button below to receive the ELD of the indicator and associated functions):

Three line break - video part 1

Three line break - video part 2

Three line break - video part 3

Three line break - video part 4

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.

If you see any errors in this tutorial – or I have not made something clear, I would be most grateful if you could please let me know. You can e-mail me at: tutorials@markplex.com. Also, let me know if you have any ideas for new tutorials.