Function to provide divergence information to strategies (and other programs)

Program 66 is a TradeStation EasyLanguage function designed to be ‘called’ by other TradeStation programs (strategies, indicators, show me studies, paintbar studies etc) to provide information about whether a price/oscillator divergence has occurred. The functionality is based on that found in Program 62 | Stochastic, RSI, TSI, CCI, MACD, and stochastic RSI.

N.B. Although the algorithms and the same in program 66 and program 62, this function does not draw the divergence lines that are drawn by program 62. In order to use the program it needs to be called by another program. I have included a simple demonstration program that calls the function with the download.

Program 66 is a TradeStation function developed using EasyLanguage designed to look for potential divergences between price and one of the following oscillators:

- Stochastic

- Relative Strength Index (RSI)

- True Strength Index (TSI)

- Commodity Channel Index (CCI)

- Moving Average Convergence/Divergence (MACD)

- Stochastic of RSI

Descriptions for these oscillators can be found on the program 62 program page.

The function, written for TradeStation 9.5 and higher, works with volume, second, tick, kagi, Kase, line break, momentum, point and figure, range, renko charts.

The UNPROTECTED function (i.e. the TradeStation EasyLanguage is fully functional and you can see the source code) and associated unprotected test showme study are available for IMMEDIATE download for $175- by clicking the ‘add to cart’ button. After download the programs can be opened, you will be able to see the program code and modify it if you wish.

The bonus show me study demonstrates the use of the function.

After purchase you will be redirected to a download page, so don’t close the browser.

The download ELD includes two programs:

- a function called _Program66

- a demonstration showme study called _Program66TEST

Note that both program names begin with an underscore, so they should be towards the start of the list if you sort alpabetically.

If you are a Gold Pass member make sure you enter the special coupon code to get 20% discount off this price.

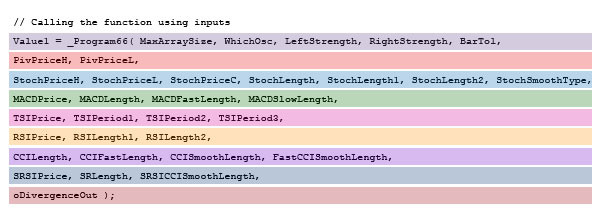

Calling the function

The function has many inputs to determine whether it uses a specific oscillator and which option to use within the oscillator as follows:

| WhichOsc user input values | Oscillator | Oscillator sub option |

|---|---|---|

| 1 | Stochastic | oFastK |

| 2 | Stochastic | oFastD |

| 3 | Stochastic | oSlowD |

| 4 | MACD | MACD |

| 5 | MACD | MACD average |

| 6 | MACD | MACD difference |

| 7 | RSI | RSI |

| 8 | RSI | RSI average |

| 9 | CCI | CCI |

| 10 | CCI | Fast CCI |

| 11 | CCI | Smoothed CCI |

| 12 | CCI | Smoothed fast CCI |

| 13 | TSI | TSI |

| 14 | TSI | TSI average |

| 15 | Stochastic of RSI | StochRSI |

| 16 | Stochastic of RSI | SmoothSRSI |

The inputs look complicated, but once a specific oscillator is selected using the WhichOsc input, only the inputs for that oscillator are relevant. This is demonstrated in the following image.

oDivergenceOut returns +1 when a bullish divergence occurs, -1 when a bearish divergence occurs, otherwise it returns 0. The function itself returns the number of bars ago that the divergence occurred.

Calling the function

Using named inputs

StochPriceH, StochPriceL, StochPriceC, StochLength, StochLength1, StochLength2, StochSmoothType,

MACDPrice, MACDLength, MACDFastLength, MACDSlowLength,

TSIPrice, TSIPeriod1, TSIPeriod2, TSIPeriod3,

RSIPrice, RSILength1, RSILength2,

CCILength, CCIFastLength, CCISmoothLength, FastCCISmoothLength,

SRSIPrice, SRLength, SRSICCISmoothLength, oDivergenceOut );

Using numbers

The values that the function returns are used, as follows, in the example show me study:

If oDivergenceOut = -1 then Plot2[Value1]( H[Value1] );

Inputs

Note: inputs for a specific oscillator only take effect is that oscillator is selected using the WhichOsc input.

The word before the input name is the data type as follows:

- int = integer (i.e. 0, 1, 2, 3 )

- double = double(i.e. 2.34236)

After the input names is a brief explanation of their use. The ‘//’ tells the program that the words are comments and they do not affect the running of the program.

The number contained within parentheses is the default value for the user input. This means that the program will run with this value unless you change it.

Input values

int MaxArraySize( 3 ), // Maximum = 5. Determines how many previous pivots are compared each time a new price pivot and corresponding oscillator pivot are discovered

int WhichOsc( 1 ), // Determines which oscillator the program uses to test for divergence

// Pivot inputs

int LeftStrength( 3 ), // Left strength of pivots

int RightStrength( 2 ), // Right strength of pivots

int BarTol( 3 ), // The number of bars within which the price and oscillator pivot must occur for the pivots to be considered to have occurred on the same bar.

Since price and the oscillator pivots do not necessarily occur on exactly the same bar, the program users the BarTol input to determine how many bars apart the price pivot and the stochastic pivot can occur to still be considered a price/oscillator pivot pair. The price pivot can occur before the oscillator pivot, or vice versa.

// Stochastic inputs

double StochPriceH( High ), // Input to stochastic calculation and price used to find high pivots

double StochPriceL( Low ), // Input to stochastic calculation and price used to find low pivots

double StochPriceC( Close ), // Input to stochastic calculation

int StochLength( 14 ), // Input to stochastic calculation

int StochLength1( 3 ), // Used to slow FastK to FastD = SlowK

int StochLength2( 3 ), // Used to slow FastD to SlowD

int StochSmoothType( 1 ), // StochSmoothType = 1 for Original, StochSmoothType = 2 for Legacy }

// MACD inputs

double MACDPrice( Close ), // Input to MACD

int MACDLength( 9 ), // Input to MACD

int MACDFastLength( 16 ), // Input to MACD

int MACDSlowLength( 26 ), // Input to MACD

// TSI inputs

double TSIPrice( Close ), // Input to True Strength Index calculation

int TSIPeriod1( 25 ), // Input to True Strength Index calculation

int TSIPeriod2( 13 ), // Input to True Strength Index calculation

int TSIPeriod3( 5 ), // Input to True Strength Index calculation

// RSI inputs

double RSIPrice( Close ), // Used in RSI calculation

int RSILength1( 10 ), // Used in RSI calculation

int RSILength2( 5 ), // Used in Exponential moving average of RSI calculation

// CCI inputs

int CCILength( 14 ), // CCI length

int CCIFastLength( 6 ), // Length of ‘fast’ CCI

int CCISmoothLength( 14 ), // Factor used to smooth CCI

int FastCCISmoothLength( 14 ), // Factor used to smooth fast CCI

// Stochastic of RSI

double SRSIPrice( Close ), // Price input to SRSI calculation

double SRSIPrice( Close ), // Price used in RSI calculation

int SRLength( 14 ), // Length used in the RSI calculation

int SRSICCISmoothLength( 5 ); // Smoothing length used to smooth the stochastic of the RSI

Program download

Program 66 was developed for TradeStation 9.5.

The UNPROTECTED function (i.e. the TradeStation EasyLanguage is fully functional and you can see the source code) and associated unprotected test showme study are available for IMMEDIATE download for $175- by clicking the ‘add to cart’ button. After download the programs can be opened, you will be able to see the program code and modify it if you wish.

The bonus show me study demonstrates the use of the function.

After purchase you will be redirected to a download page, so don’t close the browser.

The download ELD includes two programs:

- a function called _Program66

- a demonstration showme study called _Program66TEST

Note that both program names begin with an underscore, so they should be towards the start of the list.

If you are a Gold Pass member make sure you enter the special coupon code to get 20% discount off this price.

Video demonstration of program 66

Please note that any screen shots on this site are examples and are not meant to imply that any of these programs will generate profitable trades.

THESE INDICATORS, SHOW ME STUDIES, STRATEGIES AND OTHER PROGRAMS HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES.

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.