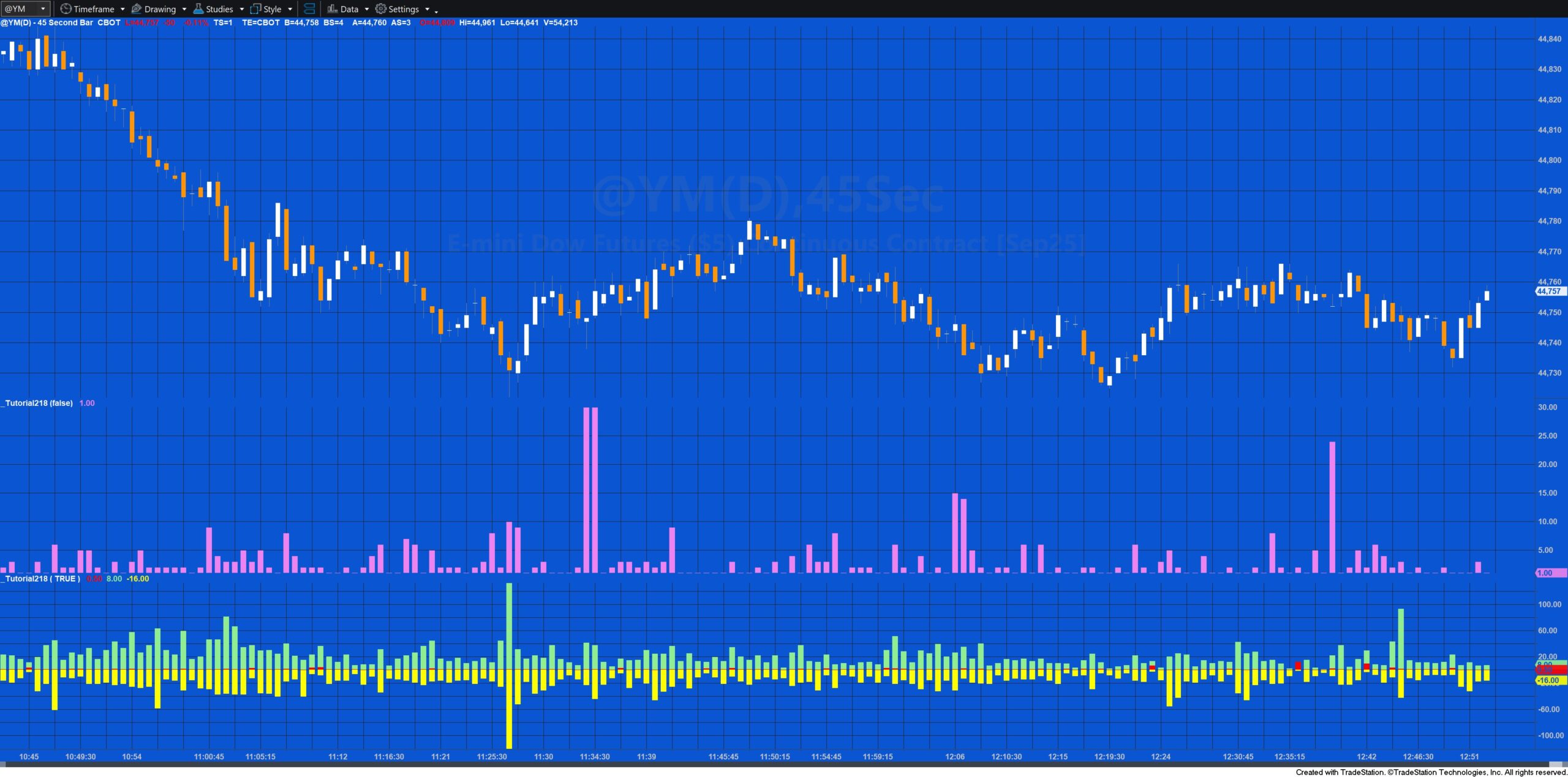

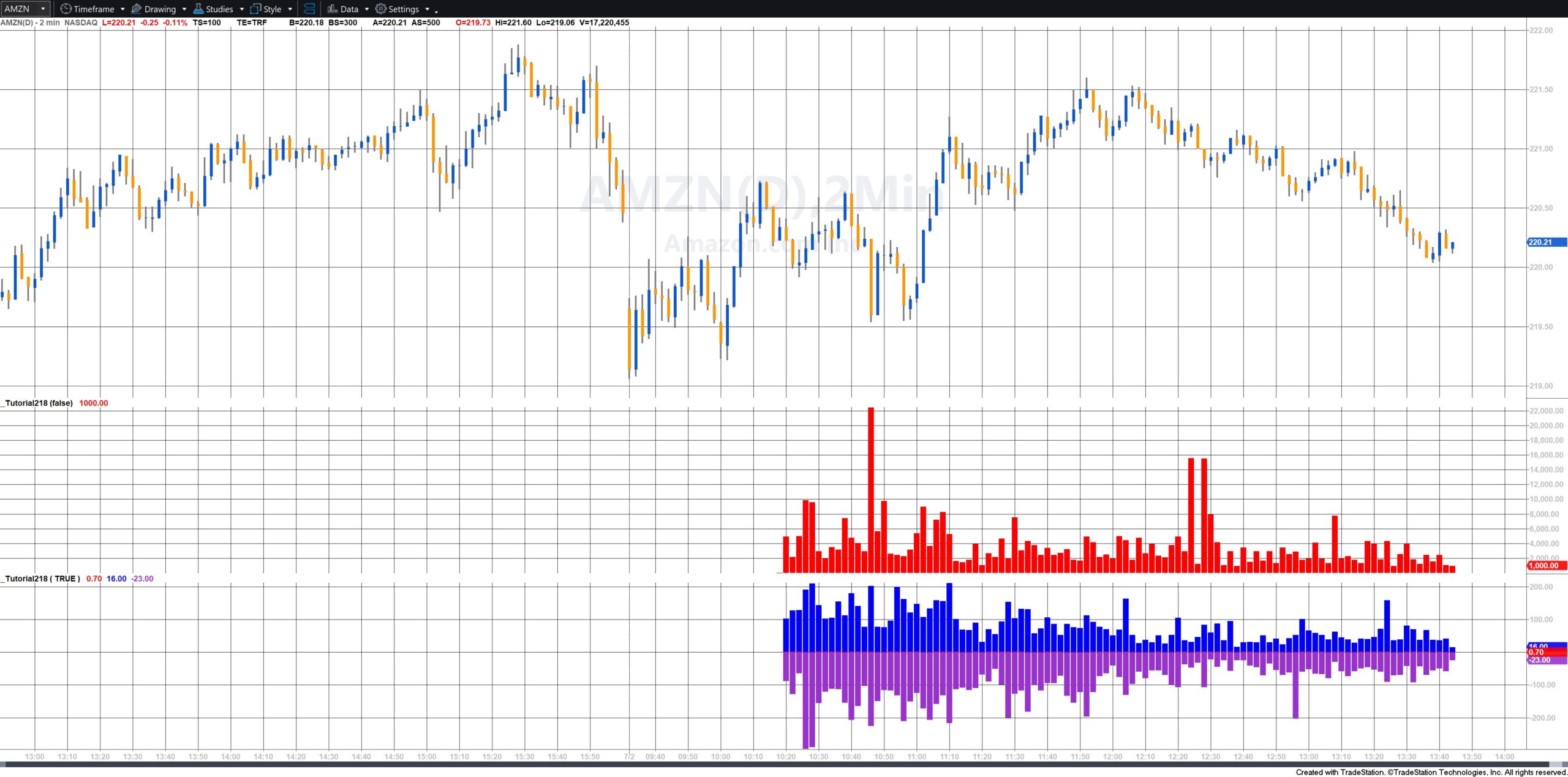

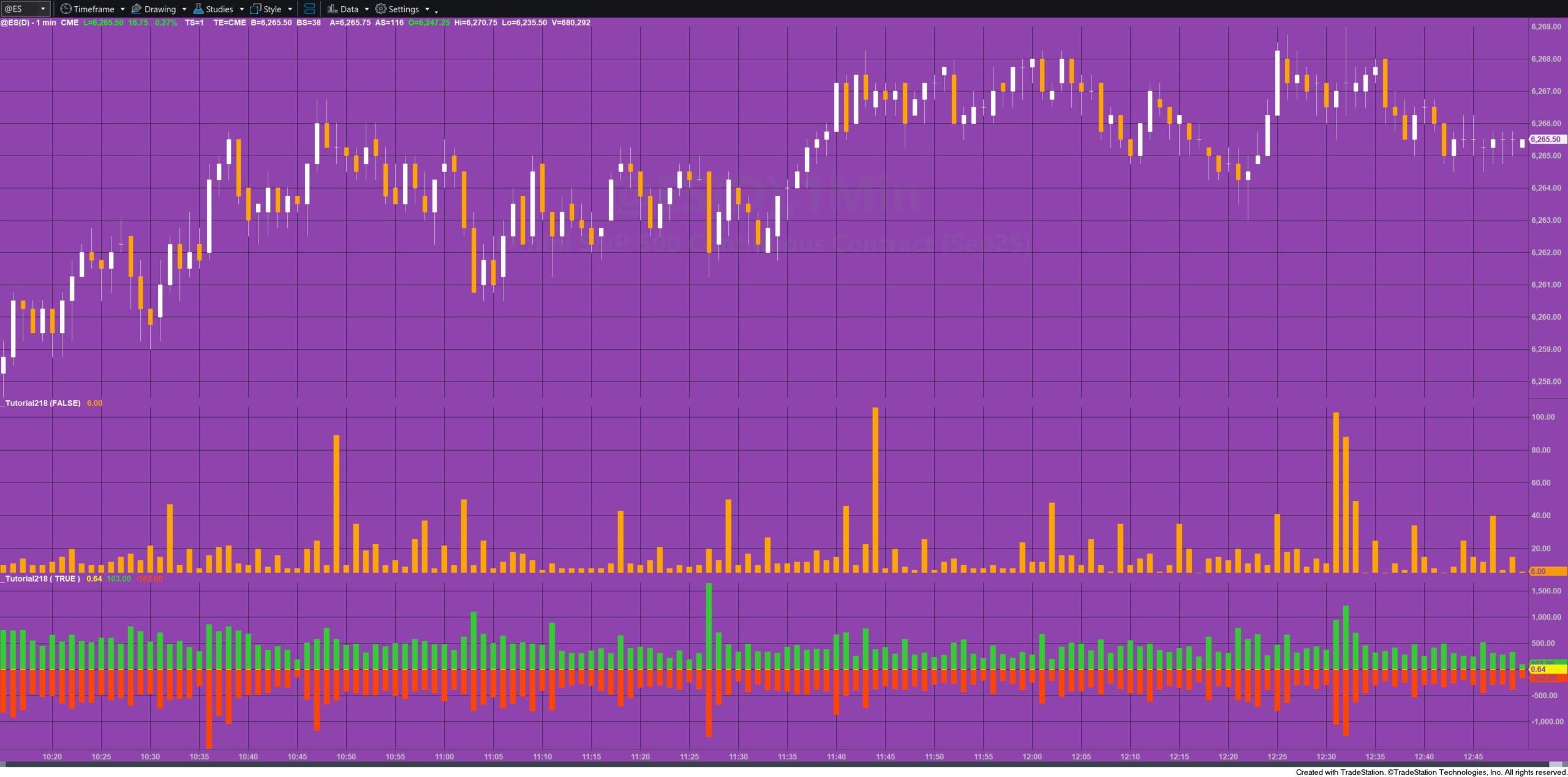

- The ratio of the number of trades made at the bid divided by the number trades made at the ask

- The number of trades made at the bid

- The number trades made at the ask

If the Ratio input is set to FALSE:

- The largest trade, by volume, for the bar

- If the update is NOT a trade, and the update is a bid, the bid price is stored in an intrabarpersist variable (LastBidPrice

- If the update is NOT a trade, and the update is an ask, the ask price is stored in an intrabarpersist variable (LastAskPrice)

- If the update IS a trade, the size of the trade (number of contracts or shares) is compared with a veriable that keeps a record of the biggest trade, so far, that bar. If the size of the trade is bigger than this number then the variable is updated.

- If the update is a trade, and its price is less than or equal to the last bid price then TradeBidCount is incremented.

- If the update is a trade, and its price is greater or equal to the latest ask price then TradeAskCount is incremented.

- The spread is very tight (e.g., 1 tick)

- The market is moving fast (quotes and trades may not align perfectly)

- There’s price improvement (e.g., a buyer gets filled between the bid and ask)

- A trade occurs inside the spread (e.g., midpoint fills).

Comments

Explanation of tutorial 218

Free download of tutorial 218 indicator for Gold Pass members

Download the tutorial 218 TradeStation EasyLanguage Indicator free for Gold Pass members If you are a Gold Pass member you can download the tutorial code below, please make sure that you are logged in with your Gold Pass user name and password.

Download the tutorial 218 program

If you wish to save yourself some typing, the tutorial programs are available for immediate download by clicking the ‘add to cart’ button below. You may pay using PayPal or a credit card. The price is $24.95

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.