Using the TradeStation EasyLanguage HorizontalLine object

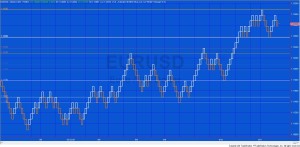

Tutorial 106 is a TradeStation EasyLanguage programming tutorial that demonstrates how to draw horizontal lines at historical pivot levels (pivot lines) on a chart using the HorizontalLine drawing object. The objective of the program is to draw horizontal lines at the level of every pivot that forms.

The tutorial only uses low pivots although I have created another version that uses low and high pivots. These lines gradually fade out as the length of time since the pivot occurred increases. After a number of bars the lines are deleted completely. The tutorial hard codes the number of bars that it looks at to 255, although this could be fairly easily increased.

This program is available as a free download for Gold Pass members, who will also receive a more advanced program that draws lines at both high and low pivots. I am also making the two programs available for download.

Tutorial 106 is different from the following programs and tutorials both in programming technique (it uses vectors rather than arrays, and doesn’t use the legacy drawing objects). It also functions by altering the opacity of lines based on age, rather than grouping lines by level.

- Tutorial 13 | Support and resistance lines based on historical pivots

- Tutorial 84 | Looking for support and resistance levels

- Program 1 | Fibonacci-confluence show-me study

- Program 2 | Pivot-confluence show-me

- Program 4 | Three line break pivot confluence

- Program 6 | Pivot confluence strategy

- Program 8 | Zig zag conflux showme

- Program 16 | Support and resistance levels combined with time zones

- Program 17 | Finding a conflux of traders’ pivots

Two different approaches

I used two different approaches to write this program.

- In the first I drew a line when each pivot was formed on historical bars. On the last bar of the chart I then looped through all the lines and deleted those for which the pivots occurred over a user defined number of bars. This program worked fine, but was wasteful of resources, as lines were drawn that ultimately would be deleted. I also started to exceed the maximum number of drawing objects allowed (and course, this depends on how much history you have loaded).

- In the second, more efficient approach”(as demonstrated in the video and included in the download), as the program processed each historical bar if a pivot was found its bar number was added to a vector. On the last bar of the chart I went though this vector and deleted all pivot information that occurred over a certain number of bars ago. I then drew the horizontal lines for the pivots that occurred more recently. Then as each new bar was formed that transparency of all the lines was adjusted, the older the line, the more transparent.

This tutorial applies to TradeStation (but not MultiCharts) because it uses TradeStation’s new drawing objects. It is tested on version 9.5, update 11.

Programming techniques

Tutorial 106 makes use of vectors, and .push_back to add new elements to the vector. It uses .Erase to modify a vector to only include a certain range of its original elements, and .Count to count the elements in the vector.

The program also makes extensive use of drawing tools as well as styling (setting the color, thickness, transparency etc) of drawing objects. DrawingObjects.Items[ ObjectCategory.HorizontalLineCreatedByAnalysisTechnique ] is used to create a vector of all the horizontal lines drawn.

The drawing tool

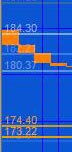

The horizontal drawing tool draws a horizontal line across the screen that keeps extending with each new bar. It also provides text showing the price level. In this program no text objects are used because the price level is automatically included with the horizontal line tool.

The horizontal drawing tool draws a horizontal line across the screen that keeps extending with each new bar. It also provides text showing the price level. In this program no text objects are used because the price level is automatically included with the horizontal line tool.

Tutorial 106 inputs

// Pivot inputs

int LeftStrength( 3 ), // Left strength of pivots

int RightStrength( 3 ), // Right strength of pivots

// Trendline attributes

int TLWeight( 3 ), // Determines the thickness oof the trendline. Valid numbers are integers between 0 and 6

int TLStyle( 0 ), // 0 = solid, 1 = dashed, 2 = dotted, 3 = dashed2, 4 = dashed3

string LowerColor( “Green” ), // Color of horizontal lines indicating at the level of low pivots

double Accel( 2 ); // Sets how quickly the line colors ‘decay’ and ‘fade’ after the pivot occurs

Tutorial 106 video

Gold pass area

Download the tutorial 106 eld: _Tutorial106.eld for $64.95

it contains the following two programs:

- _Tutorial 106 NEW (the program demonstrated in the video)

- _Tutorial 106 NEW HiLo (the program that analyzes high and low pivots)

This tutorial applies to TradeStation (but not MultiCharts) because it uses TradeStation’s object oriented extensions. The programs have been tested with TradeStation 9.5 update 11.

Gold pass members can download the program at no cost (see the Gold Pass area above. Make sure you are logged in to the site).

Please join our email list if you have not already done so and we will let you know when we release new tutorials or programs.

Available colors

| AliceBlue | DarkSlateGray | LightSalmon | PaleVioletRed |

| AntiqueWhite | DarkTurquoise | LightSeaGreen | PapayaWhip |

| Aqua | DarkViolet | LightSkyBlue | PeachPuff |

| Aquamarine | DeepPink | LightSlateGray | Peru |

| Azure | DeepSkyBlue | LightSteelBlue | Pink |

| Beige | DimGray | LightYellow | Plum |

| Bisque | DodgerBlue | Lime | PowderBlue |

| Black | Firebrick | LimeGreen | Purple |

| BlanchedAlmond | FloralWhite | Linen | Red |

| Blue | ForestGreen | Magenta | RosyBrown |

| BlueViolet | Fuschia | Maroon | RoyalBlue |

| Brown | Gainsboro | MediumAquamarine | SaddleBrown |

| Burlywood | GhostWhite | MediumBlue | Salmon |

| CadetBlue | Gold | MediumOrchid | SandyBrown |

| Chartreuse | Goldenrod | MediumPurple | SeaGreen |

| Chocolate | Gray | MediumSeaGreen | Seashell |

| Coral | Green | MediumSlateBlue | Sienna |

| CornflowerBlue | GreenYellow | MediumSpringGreen | Silver |

| Cornsilk | Honeydew | MediumTurquoise | SkyBlue |

| Cyan | HotPink | MediumVioletRed | SlateBlue |

| DarkBlue | IndianRed | MidnightBlue | SlateGray |

| DarkBrown | Indigo | MintCream | Snow |

| DarkCyan | Ivory | MistyRose | SpringGreen |

| DarkGoldenrod | Khaki | Moccasin | SteelBlue |

| DarkGray | Lavender | NavajoWhite | Tan |

| DarkGreen | LavenderBlush | Navy | Teal |

| DarkKhaki | LawnGreen | OldLace | Thistle |

| Dark Magenta | LemonChiffon | Olive | Tomato |

| DarkOliveGreen | LightBlue | OliveDrab | Turquoise |

| DarkOrange | LightCoral | Orange | Violet |

| DarkOrchid | LightCyan | OrangeRed | Wheat |

| DarkRed | LightGoldenrodYellow | Orchid | White |

| DarkSalmon | LightGray | PaleGoldenrod | WhiteSmoke |

| DarkSeaGreen | LightGreen | PaleGreen | Yellow |

| DarkSlateBlue | LightPink | PaleTurquoise | YellowGreen |

TO THE BEST OF MARKPLEX CORPORATION’S KNOWLEDGE, ALL OF THE INFORMATION ON THIS PAGE IS CORRECT, AND IT IS PROVIDED IN THE HOPE THAT IT WILL BE USEFUL. HOWEVER, MARKPLEX CORPORATION ASSUMES NO LIABILITY FOR ANY DAMAGES, DIRECT OR OTHERWISE, RESULTING FROM THE USE OF THIS INFORMATION AND/OR PROGRAM(S) DESCRIBED, AND NO WARRANTY IS MADE REGARDING ITS ACCURACY OR COMPLETENESS. USE OF THIS INFORMATION AND/OR PROGRAMS DESCRIBED IS AT YOUR OWN RISK.

ANY EASYLANGUAGE OR POWERLANGUAGE TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (AND PARTS THEREOF) AND ASSOCIATED TECHNIQUES REFERRED TO, INCLUDED IN OR ATTACHED TO THIS TUTORIAL OR PROGRAM DESCRIPTION ARE EXAMPLES ONLY, AND HAVE BEEN INCLUDED SOLELY FOR EDUCATIONAL PURPOSES. MARKPLEX CORPORATION. DOES NOT RECOMMEND THAT YOU USE ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS (OR ANY PARTS THEREOF) OR TECHNIQUES. THE USE OF ANY SUCH TRADING STRATEGIES, SIGNALS, STUDIES, INDICATORS, SHOWME STUDIES, PAINTBAR STUDIES, PROBABILITYMAP STUDIES, ACTIVITYBAR STUDIES, FUNCTIONS AND TECHNIQUES DOES NOT GUARANTEE THAT YOU WILL MAKE PROFITS, INCREASE PROFITS, OR MINIMIZE LOSSES.